The 2026 M&A Landscape: Why We Are Prioritizing Niche Home Health and Hospice Agencies

This blog post explains why Senate Healthcare is prioritizing acquisitions of niche home health and hospice agencies in 2026. It addresses the succession gap facing many owners, provides transparent valuation comparisons between specialized and generalist agencies, and invites owners in the $2M to $10M revenue range to start a confidential conversation about their exit options.

1/26/20265 min read

This post explains why Senate Healthcare is actively seeking to acquire niche home health and hospice agencies in 2026. If you own a specialized agency and are thinking about your next chapter without a clear succession plan, this is written directly for you.

Quick-Scan Summary

Who this is for:

Home health or hospice agency owners generating $2M to $10M in annual revenue

Founders with no clear internal successor or family member ready to take over

Operators running specialized programs (cardiac, neuro, pediatric, disease-specific care)

Owners who want their agency's mission and staff culture to continue after they step back

Key takeaways:

Senate Healthcare is actively acquiring niche home health and hospice agencies in 2026

We prioritize specialized care models because they deliver better patient outcomes and operational stability

We offer a direct path to exit for founders facing the "succession gap"

Niche agencies command higher valuations than generalist operations, and we pay accordingly

No brokers required. We work directly with owners in confidential, straightforward conversations

The Buyer's Perspective: Why We're in the Market Now

The 2026 M&A environment for home health and hospice has shifted dramatically. After a multi-year slowdown, transaction activity surged in late 2025, with Q4 recording the highest quarterly deal volume since 2021. Falling interest rates, a narrowing gap between seller expectations and buyer valuations, and significant private equity capital ready to deploy have all contributed to renewed momentum.

At Senate Healthcare, we see this moment as the right time to grow. But we are not interested in acquiring agencies simply to accumulate scale. Our focus is deliberate: we want to partner with owners who have built something meaningful, something specialized, something worth preserving.

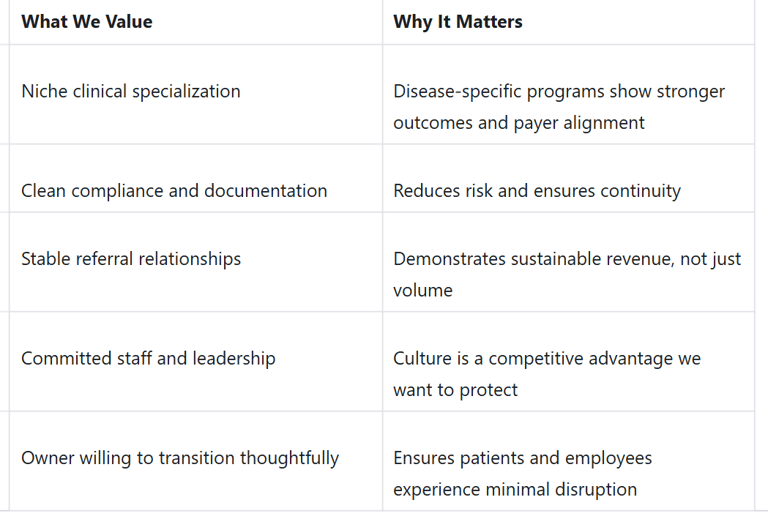

Here is what we are looking for:

We are not private equity buyers looking to flip an asset. We are operators building a long-term platform. That distinction matters when it comes to how we approach acquisitions and how we treat the agencies we bring into our organization.

The Succession Solution: Addressing the Gap Many Owners Face

If you built your agency from the ground up, you know the weight of that responsibility. You hired your first clinician. You built relationships with referral sources over years. You created a culture that puts patients first.

Now you are looking ahead. Maybe you are five years from retirement. Maybe you are already there. The question becomes: who takes over?

For many agency owners, the answer is unclear. Your children may not want to run a healthcare business. Your leadership team might not have the capital or appetite to buy you out. Selling to a large national chain feels like erasing everything you built.

This is the succession gap, and it is more common than most people discuss openly.

Senate Healthcare offers a different path. We acquire agencies with the intention of continuing their legacy, not dismantling them. We keep clinical leadership in place when it makes sense. We honor the culture that made your agency successful. And we provide you with a clean exit that reflects the real value of what you built.

For more on how succession planning affects agency value, read our guide on succession planning as a strategic advantage.

Why Niche Beats Generalist in 2026

The market is telling a clear story right now: specialization wins.

Private equity firms and strategic acquirers are prioritizing agencies with defined clinical niches. Cardiac care at home. Neuro-focused rehabilitation. Pediatric palliative programs. Disease-specific hospice expertise. These agencies are not just clinically excellent. They are operationally resilient and better aligned with where payer models are heading.

Why does this matter for valuations?

Generalist agencies, those offering broad services without a defined specialty, typically trade at lower EBITDA multiples. Buyers see them as commoditized and more vulnerable to reimbursement pressure. Niche agencies, by contrast, command premiums because they offer:

Differentiated referral relationships that are harder to replicate

Higher patient satisfaction and outcomes data

Better positioning for Medicare Advantage and value-based contracts

Lower staff turnover due to specialized training and culture

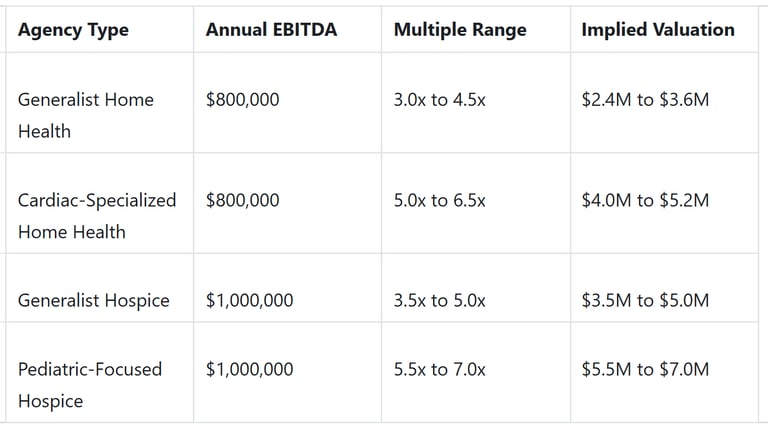

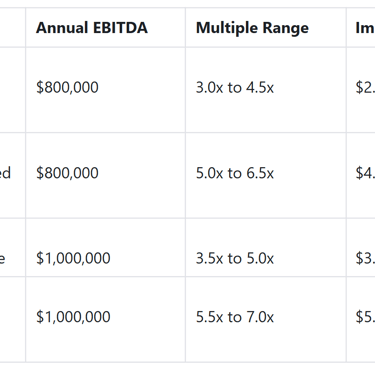

Valuation Comparison: Niche vs. Generalist

Let's make this concrete with an example.

Same EBITDA. Very different outcomes. The difference can mean $1.5M to $2M or more in your pocket at closing.

At Senate Healthcare, we recognize this value and structure our offers accordingly. If you have built a specialized program with strong clinical outcomes and stable operations, we want to have a conversation.

The Medicare Advantage Factor

One trend driving buyer interest in niche agencies is the growth of Medicare Advantage and value-based care models. MA plans are increasingly "carving in" home health and hospice benefits, meaning they want to work with providers who can demonstrate quality, efficiency, and specialization.

Agencies with disease-specific expertise are better positioned to win these contracts. They can show outcomes data. They can negotiate from a position of strength. And they are more attractive to acquirers who are building platforms designed for the value-based future.

If your agency is already working with MA plans or has the infrastructure to do so, that is a significant value driver in any acquisition discussion. For more on this topic, see our post on value-based care positioning for hospice owners.

So What Should You Do Now?

If you are reading this and thinking about your own situation, here are four steps to consider:

Assess your specialization. Do you have a defined clinical niche, or are you a generalist? If you have specialized programs, document their outcomes and referral relationships.

Review your compliance posture. Clean documentation and survey history matter to buyers. If there are gaps, address them now. Our compliance checklist can help.

Get your financials in order. Ensure your EBITDA is clearly calculated and defensible. Buyers will scrutinize add-backs and adjustments.

Start the conversation early. You do not need to be ready to sign tomorrow. The best transitions happen when owners begin discussions 12 to 24 months before their target exit date.

Let's Talk Directly

Senate Healthcare is actively seeking home health and hospice agencies to acquire in 2026. We are particularly interested in operators who have built specialized, high-quality programs and are facing the succession question without a clear answer.

We work directly with owners. No brokers required. No intermediaries adding complexity. Just a straightforward, confidential conversation about whether a partnership makes sense for both sides.

If you own a home health or hospice agency generating $2M to $10M in revenue and want to explore your options, contact us for a confidential discussion.

Plain-Language Glossary

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization. A common measure of operating profit used to value healthcare agencies.

Multiple: The number applied to EBITDA to determine enterprise value. A 5x multiple on $1M EBITDA equals a $5M valuation.

Succession Gap: The situation where an owner wants to exit but has no clear internal buyer, family successor, or transition plan.

Niche Agency: A home health or hospice provider with a defined clinical specialization rather than broad, generalist services.

Medicare Advantage (MA): Private insurance plans that contract with Medicare to provide benefits, increasingly including home health and hospice services.

Value-Based Care: Payment models that reward quality and outcomes rather than volume of services delivered.

Resources:

https://www.mertztaggart.com/post/q4-2025-home-based-care-m-a-report

https://hospicenews.com/2025/12/30/the-hospice-ma-locomotive-gains-momentum-in-2025/

https://hospicenews.com/2026/01/12/5-hospice-trends-to-watch-in-2026/

https://www.lincolninternational.com/private/home-health-and-hospice-is-an-evolving-ma-environment/

https://www.stoneridgepartners.com/2025/12/08/home-health-index-2025-november-update/

Unlock Your 30-Minute Agency Succession Review

Maybe you're ready to expand your reach, or perhaps it's time to consider your legacy and the future of your business. Either way, it all begins with a conversation. Schedule a confidential, no-obligation call to explore what the future might hold for you and your business.

Complete the form, and we'll reach out for a chat...

© 2025 SENATE HEALTHCARE LLC.

ALL RIGHTS RESERVED