Home Health Faces Its Biggest Test: The Proposed 2026 Medicare Payment Cuts and Industry Response

The home health industry faces its most severe financial challenge since 2020, as CMS proposes unprecedented Medicare payment cuts of 6.4% (effectively 9.06% gross reduction) for 2026. This comprehensive analysis examines the proposed cuts, industry response, congressional intervention efforts, and what these changes mean for home health agencies nationwide.

10/27/20255 min read

The Centers for Medicare & Medicaid Services (CMS) has delivered what many consider a devastating blow to the home health industry with its Calendar Year 2026 Home Health Prospective Payment System (HH PPS) Proposed Rule, released on June 30, 2025. The proposal introduces the most significant reimbursement reduction the sector has faced since the implementation of the Patient-Driven Groupings Model (PDGM) in 2020.

The Numbers Behind the Crisis

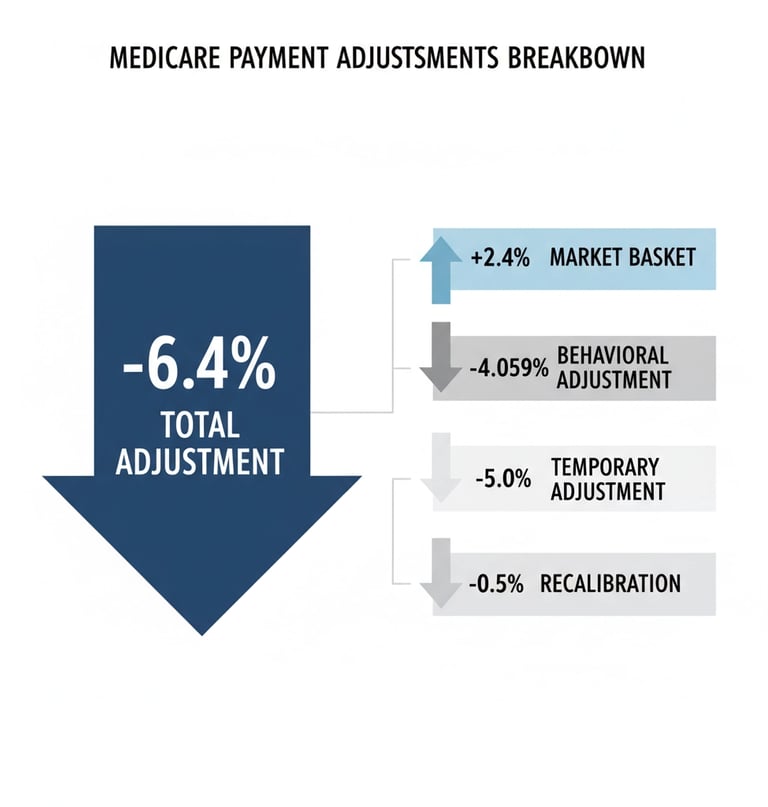

The headline figure shows a 6.4% net reduction of $1.135 billion in Medicare payments to home health agencies for 2026 compared to 2025. However, this understates the true impact. When accounting for gross reductions before inflationary updates, the total proposed cut reaches 9.06%, making this the largest single-year reduction on record according to Home Health Care News and Applied Policy.

The breakdown reveals the complexity behind this reduction:

+2.4% market basket update (increase to account for inflation)

-4.059% permanent behavioral adjustment to the base rate

-5.0% temporary adjustment to recoup alleged overpayments from prior years

-0.5% recalibration of the fixed-dollar loss ratio for outlier payments

The national standardized 30-day payment rate would drop from $2,057 in 2025 to $1,934 in 2026. CMS justifies these changes by noting that payments to the home health sector in 2024 exceeded costs by 33%, suggesting the industry has been overcompensated under current payment structures.

Industry Alarm and Immediate Impact

Home health advocates have expressed unprecedented alarm about the proposed cuts. Home Health Care News reports that more than 150 organizations, led by the National Alliance for Care at Home and LeadingAge, have urged Congress to intervene to stop what they describe as the largest rate reduction in history, a development also summarized by Applied Policy.

Dr. Steve Landers, CEO for National Alliance for Care at Home, characterized the proposal as "negligent" and warned it "threatens to further diminish care access by compelling more HHAs to take similar actions" of closing or reducing services.

These concerns aren't theoretical. CMS acknowledges evidence of a reduction in the number of visits home health agencies conduct across all clinical disciplines including nursing, physical and occupational therapy, and speech-language pathology since PDGM's implementation. Industry stakeholders have documented increasing unfilled referrals, delays in care, and home health agency closures as a result of prior payment reductions.

The broader healthcare system would also feel the impact. Limited access to home health makes it harder to discharge patients from hospitals and skilled nursing facilities to their homes, thereby increasing overall Medicare costs and creating bottlenecks throughout the healthcare continuum.

Congressional Response and Political Pressure

The proposed cuts have galvanized significant bipartisan opposition. Senators Marsha Blackburn (R-Tennessee) and Susan Collins (R-Maine) sent a formal letter to CMS Administrator Dr. Mehmet Oz expressing serious concern about the home health benefit and the future of home health agencies, requesting a substantive response from the agency.

The Alliance for Care at Home has mobilized over 150 organizations in a coordinated letter to congressional leadership, calling for immediate intervention to stop the proposed cuts. This unprecedented coalition includes hospitals, home health agencies, hospice providers, and patient advocacy groups.

Industry organizations including the American Hospital Association (AHA), American Physical Therapy Association (APTA), and American Occupational Therapy Association (AOTA) have submitted formal comments to CMS during the public comment period, which concluded in late August 2025.

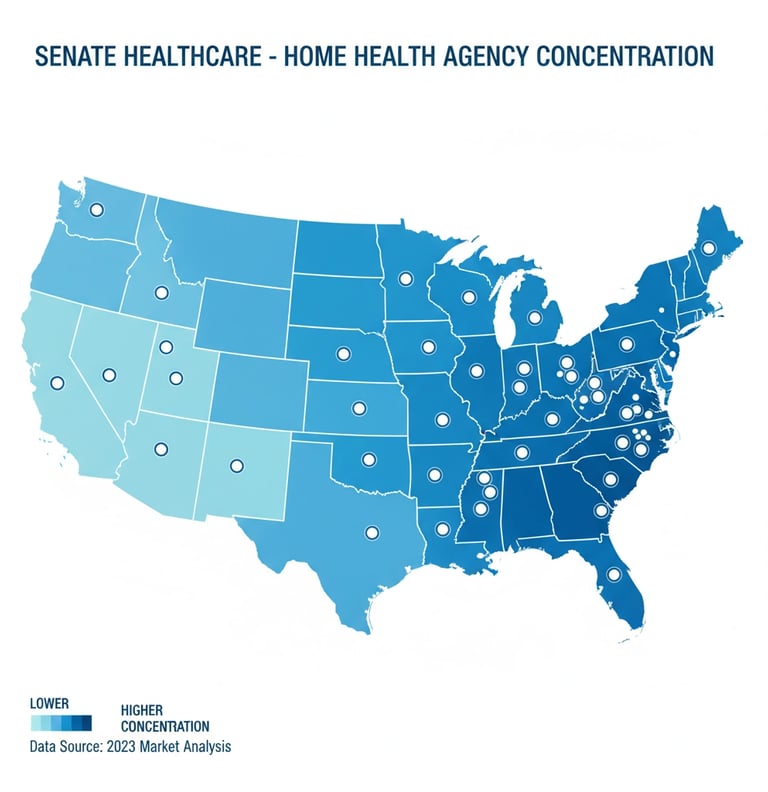

States with the highest concentration of home health agencies potentially affected by the proposed cuts

The $5 Billion Clawback Challenge

A significant driver of the temporary 5% adjustment relates to a growing clawback deficit that has reached $5 billion, which CMS seeks to recover through payment reductions. This temporary adjustment alone would collect approximately $786 million toward addressing the total deficit.

The clawback stems from CMS's position that home health agencies received overpayments during the PDGM implementation period, as actual provider behavior differed from initial projections. However, industry leaders argue that these "overpayments" represent legitimate compensation for quality care delivery and operational improvements agencies made during a challenging transition period.

Additional Policy Changes on the Horizon

Beyond payment reductions, the 2026 proposed rule includes several operational changes affecting home health agencies:

Expanded Practitioner Eligibility: CMS proposes aligning with the CARES Act by allowing non-physician practitioners (nurse practitioners, clinical nurse specialists, and physician assistants) to conduct Medicare-required face-to-face encounters, regardless of whether they are the certifying provider.

Updated Quality Measures: The proposal includes implementation of a revised Home Health Consumer Assessment of Healthcare Providers and Systems (HHCAHPS) survey starting April 2026 and expansion of Outcome and Assessment Information Set (OASIS) data requirements.

Program Modifications: Proposed changes to the Home Health Quality Reporting Program (HHQRP) measures, Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) accreditation rules, competitive bidding program, and Medicare provider enrollment requirements.

Strategic Implications for Agency Owners

For home health agency owners, these proposed cuts represent more than operational challenges they signal a fundamental shift in the Medicare home health landscape. Agencies must now evaluate their strategic options more critically than ever.

Some agencies may accelerate succession planning or explore strategic partnerships to maintain viability. Others might consider full exits from the Medicare program or transitions to private-pay models. The proposed cuts also highlight the importance of having experienced advisors who understand both regulatory complexities and strategic alternatives.

Senate Healthcare has been tracking these reimbursement and regulatory updates and their impact on agency valuations throughout 2025. Agency owners considering their options should evaluate how these changes affect both immediate operations and long-term strategic value.

What Happens Next

The final rule is expected to be released by November 1, 2025, with implementation beginning January 1, 2026. However, the unprecedented level of opposition from industry stakeholders and bipartisan congressional concern suggests the fight is far from over.

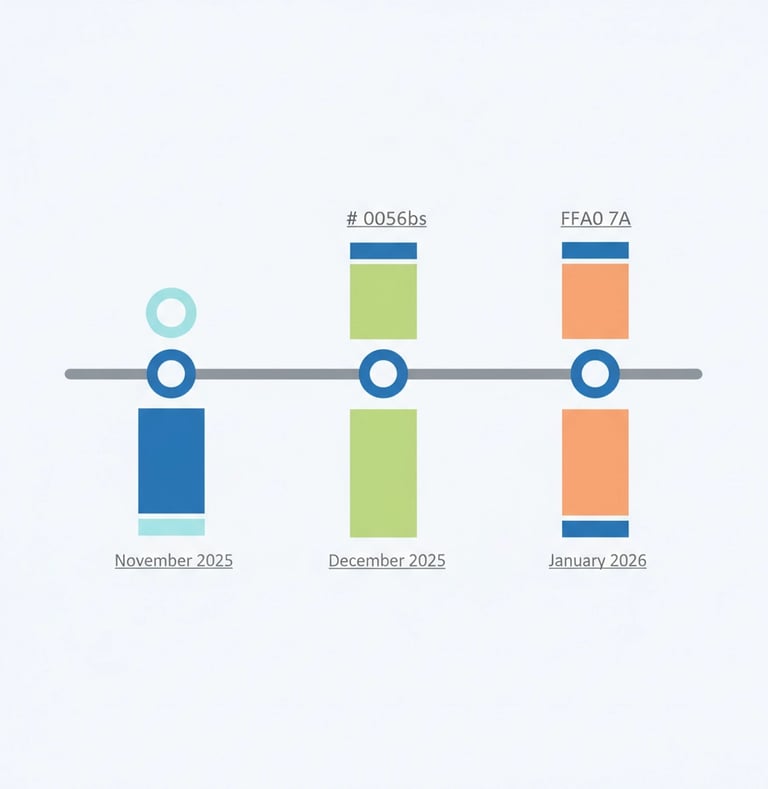

Key dates to watch include:

November 1, 2025: CMS expected to release final rule

December 2025: Final preparation period for agencies

January 1, 2026: Proposed cuts take effect (if finalized)

Industry advocates continue pushing for congressional intervention that could delay or modify the proposed cuts. Some organizations are exploring legal challenges if the rule is finalized as proposed.

The home health industry stands at a critical juncture. The proposed 2026 payment cuts represent the most significant threat to the sector's financial stability in recent memory. How CMS responds to the overwhelming opposition and whether Congress intervenes will determine not just the future of payment rates, but the viability of home-based care for millions of Medicare beneficiaries.

For agency owners navigating this uncertainty, staying informed about regulatory developments while maintaining strategic flexibility has never been more important. The decisions made in the coming months will shape the home health landscape for years to come.

Unlock Your 30-Minute Agency Succession Review

Maybe you're ready to expand your reach, or perhaps it's time to consider your legacy and the future of your business. Either way, it all begins with a conversation. Schedule a confidential, no-obligation call to explore what the future might hold for you and your business.

Complete the form, and we'll reach out for a chat...

© 2025 SENATE HEALTHCARE LLC.

ALL RIGHTS RESERVED